Avina Vidyadharan

Hamilton Council’s proposed rates hike – average 25.5% – will likely knock renters deeper into a hole, warns a budget advisor.

Mike Rolton, general manager of Vinnies Hamilton, says landlords will put up rents to reflect the increase and the result for his clients – some already paying up to 70% of their household income – will be devastating.

“The domino effect would be those people (renters) would be further and further down the hole and they’d be really struggling… and there’d be a lot of pressure on organisations like us to support them.

“It’s a wrong thing to do at the wrong time.

“The cost of living is still high and inflation is not really going to reduce till 2025 so the whole thing would be quite devastating for people in that position and people that we deal with if that happened.”

Hamilton city councillors last week voted for a proposed average rates jump of 25.5% for the next financial year.

The draft budget outlining the proposal is aimed at biting down on borrowing by balancing spending and revenue quicker, while maintaining current services.

However, Diana, who is on a fixed pension and rents, says the increase in rates will be catastrophic.

“My rent just went up in October and if anything else happens, my landlords are likely to put it up again.

“The power goes up and food’s gone up and it’s just really tough for a person on a pension.

“If it wasn’t the likes of Vinnies helping me out each week with a food parcel, some weeks I wouldn’t even eat.”

Superannuant Diana, 70, says she already struggles to eat some weeks, so a rent increase would be catastrophic (file photo).

Superannuant Diana, 70, says she already struggles to eat some weeks, so a rent increase would be catastrophic (file photo).123RF

Diana, 70, said there were other pensioners in the “same boat or even worse off”.

“By the time I pay my rent and put money aside for the power bill, I’m left with $65 a fortnight, and with that I have to manage the food and all the other necessities – doctors and stuff like that.”

Rolton said the food bank was seeing many new faces, including mortgage holders who are struggling to keep up with increasing interest rates, other utilities, and food.

“Both parents work, and in some cases one of the parents has two jobs, and they’re still struggling to make ends meet and meet all those costs.

“Their pay makes up for four days’ expenses and they just have no savings and nothing to fall back on… They drive to work in the car and if the car breaks down or they need new tyres and they purchase those things or get the car fixed, then they’ve got to decide ‘do we have to go to a food bank, do we pay our rent?’ or something like that.”

The number of food parcels increased from 600 a year in 2017 to over 6000 in 2023 so far.

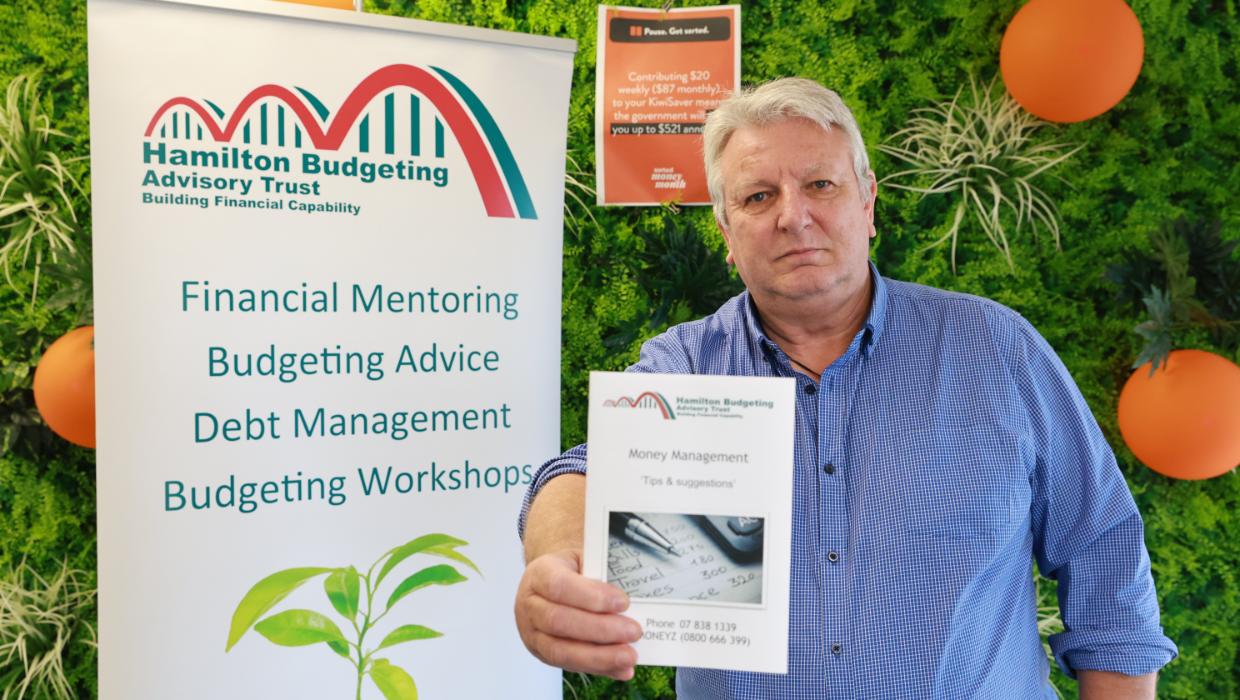

Hamilton Budgeting Advisory Trust manager Tony Agar says more clients are seeking advice on KiwiSaver withdrawals for financial hardship.

Hamilton Budgeting Advisory Trust manager Tony Agar says more clients are seeking advice on KiwiSaver withdrawals for financial hardship.MARK TAYLOR / WAIKATO TIMES

Hamilton Budgeting Advisory Trust manager Tony Agar said people were cutting back on food or buying groceries using Buy Now Pay Later services due to increasing costs.

The problem would compound when landlords eventually put up their rents because of higher council rates – and Hamilton rents are already “very high”.

“There’s also an issue there with our superannuants, who are homeowners and probably have already paid off their mortgage but living on a super, that hiking pay rates, even though they can get a rebate, it’s still a significant hike in their cost of living.”

Agar said the agency was seeing an increasing number of clients seeking advice on KiwiSaver withdrawals.

“The 25.5% hike in rates is a significant amount that’s going to have an effect on people’s budgets, particularly taking into account all the other increases in cost of living that we’ve seen recently.”